As deal volumes topple records and investors speculate about public equity market peaks, some may wonder if the time is all wrong for private equity and debt investments. We sat down with members of Neuberger Berman’s Private Equity and Debt teams to get their thoughts on current prospects, and how elevated prices are affecting their opportunity set. They all made the case that rules tied to public market investing don’t necessarily apply to private capital.

Private Capital in a Time of High Valuations

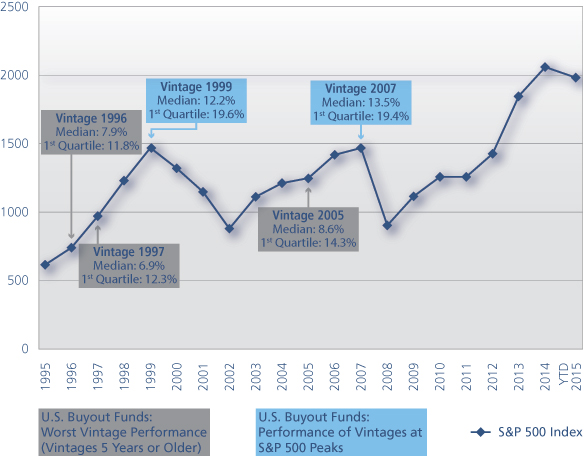

Anthony D. Tutrone, global head of Alternatives at Neuberger Berman, offered a perspective that may seem counterintuitive: Public market peaks have historically been a great time to commit new private equity capital. When you compare median returns on different so-called vintages of private equity, the vintages that coincide with S&P 500 peaks are actually the best performers. Meanwhile, the lowest-returning private equity vintages have occurred about two to three years before an S&P 500 peak (see display).

S&P 500 Market Peaks Have Coincided With Strong Buyout Vintages

Source: S&P 500 Index from Capital IQ, as of year-end since 1995 through August 16, 2015. Cambridge Index U.S. Buyout Private Equity Index; IRR Statistics as of March 31, 2015 (the most recent available).

“The reason for that is pretty simple,” said Tutrone. “When you commit to a private equity fund, they’re investing those dollars over, say, five years. So if the public market is peaking, they’re investing on the way down and potentially selling on the way back up.” Private equity dollars that were committed earlier in the cycle, on the other hand, might be caught investing as public market valuations climb, and then selling in a weak environment as markets fall. “Even in the worst-performing vintage years [shown in the chart above], returns for the top-quartile managers have been fairly strong and the performance for the managers performing at the median are not bad, although they are not on par with what an investor is looking for when they chose to invest in the PE asset class.”

In the secondary private equity market, current market valuations are not necessarily a determinant of future returns. Tristram Perkins, a managing director with Neuberger Berman’s Secondaries team, noted that one of the appeals of secondary investments is that they can broaden an investor’s exposure to different private equity entry points. “Secondaries are a tactical way to build diversification by back-dating your vintages. Most secondary transactions are on private equity deals and continuing capital commitments that are five to seven years old. The duration is fundamentally different than new commitments.”

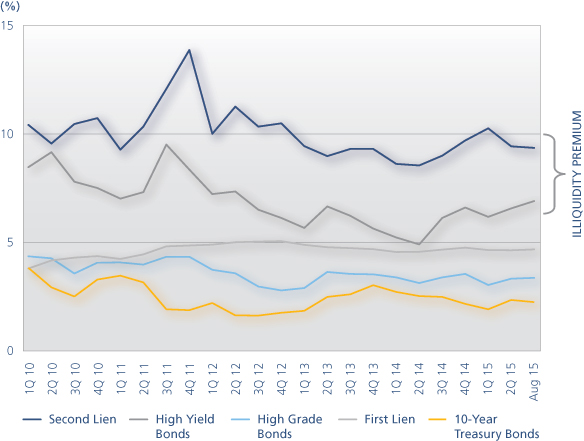

Private debt markets also have some insulation against rich real-time valuations. Susan Kasser, who heads up the firm’s Private Debt team, pointed out that private debt is not traded on a secondary market, so existing loan holdings do not fluctuate in value the way that public debt investments can. What’s more, pressure on yields in the public market does not always manifest the same way for new private debt deals. “The private debt market is a bit of an absolute return strategy,” said Kasser. A look at the historical yield on second lien loans, a good proxy for the private debt market according to Kasser, shows that loan rates have generally stayed close to 10% even when other market yields have dipped (see display).

Second Lien Loans Offer Steady Illiquidity Premium

Source: Bloomberg, Credit Suisse, Barclays, S&P LCD. Data as of August 31, 2015. Yields represent: U.S. Government Generic 10-Year Index, Barclays Corporate Investment Grade Index, 1st Lien Current Yields from Credit Suisse Leveraged Loans Index, Barclays Corporate High Yield Bond Index.

Finding the Competitive Edge

Private capital market returns depend on a wide range of factors beyond public market valuations. “Private debt is a fundamentally passive strategy,” said Kasser. Because lenders do not have operational control over management, and because their loan values do not fluctuate day to day, Kasser believes value creation relies entirely on “the buy.” To build a successful portfolio, investors should have access to a lot of deals and be selective as to which loans to make.

In the secondary investment universe, staying competitive is about staking a claim in the right part of the market, according to Perkins. The largest secondary deals often happen through auctions, where large institutional buyers are bidding on deals. One way to capture pricing advantages is by focusing on smaller deals, which tend to be less competitive for buyers, he said.

Everything Is Connected

The three managers agree that maintaining a competitive edge in private markets often hinges on having a deep network of relationships. “Being active across multiple funds and advisory boards can be a treasure trove of information about deal flow,” said Tutrone.

For private debt, Kasser believes relationships are key, but so is having a backbone. “As a lender, you have to find the right companies to lend to at the right leverage for the right price with the right contractual protection. That’s it.” You not only have to work for access to deals, you have to be able to say no to the unfavorable ones while preserving access to future deal offers.

Creating Competitive Advantages Across Market Environments

The managers remarked that richly priced markets do influence their decisions, but that investors can’t think of the private capital markets in the same way they consider public investments. “In public equity markets, there’s only one alpha driver—buying a security below its intrinsic value,” said Tutrone. Private capital markets are fundamentally different. In the case of direct equity investments, investors often have some control over the company, the balance sheets and financing decisions, and the exit timing. What’s more, deals may clear below the highest possible price, because as Tutrone put it, “sellers have unique reasons why they want to sell, other than price.”

As with any asset class, timing private capital is difficult. But none of the managers sees market timing as the main value driver. Selectivity on deals is essential, and tends to be a function of careful research and, importantly, access to deal flow.

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees and advisory clients may hold positions of companies within sectors discussed. Specific securities identified and described do not represent all of the securities purchased, sold or recommended for advisory clients. It should not be assumed that any investments in securities identified and described were or will be profitable. Any views or opinions expressed may not reflect those of the firm as a whole. Information presented may include estimates, outlooks, projections and other “forward looking statements.” Due to a variety of factors, actual events may differ significantly from those presented. Neuberger Berman products and services may not be available in all jurisdictions or to all client types. Investing entails risks, including possible loss of principal. Investments in hedge funds and private equity are speculative and involve a higher degree of risk than more traditional investments. Investments in hedge funds and private equity are intended for sophisticated investors only. Unless otherwise indicated returns shown reflect reinvestment of dividends and distributions. Indexes are unmanaged and are not available for direct investment. Past performance is no guarantee of future results.

This material is being issued on a limited basis through various global subsidiaries and affiliates of Neuberger Berman Group LLC. Please visit www.nb.com/disclosure-global-communications for the specific entities and jurisdictional limitations and restrictions.

The “Neuberger Berman” name and logo are registered service marks of Neuberger Berman Group LLC.